Stock Redemption Tax Treatment

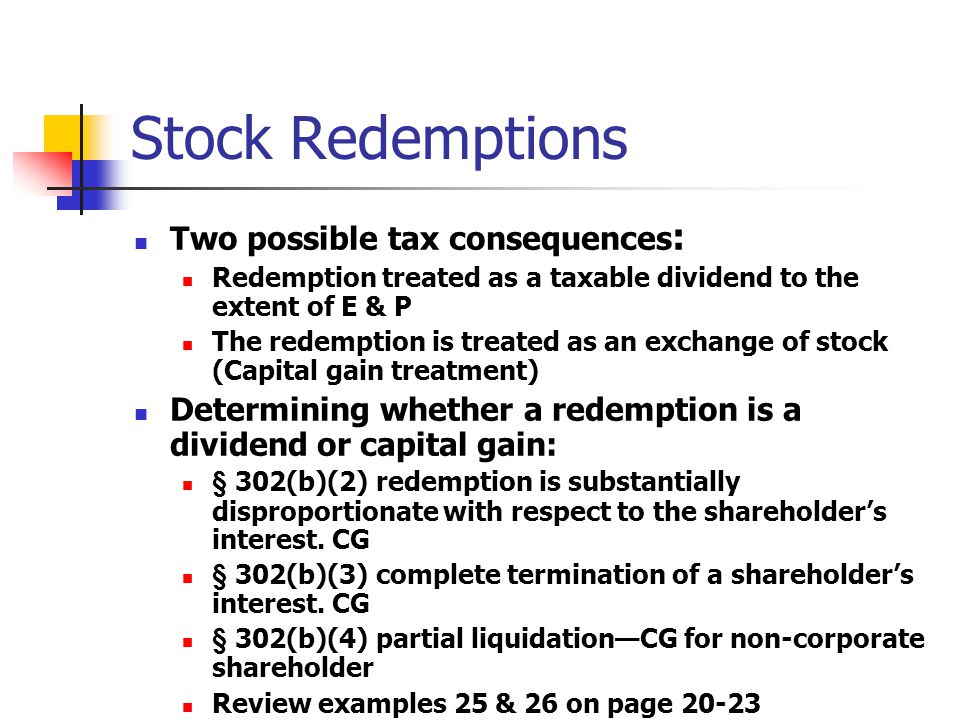

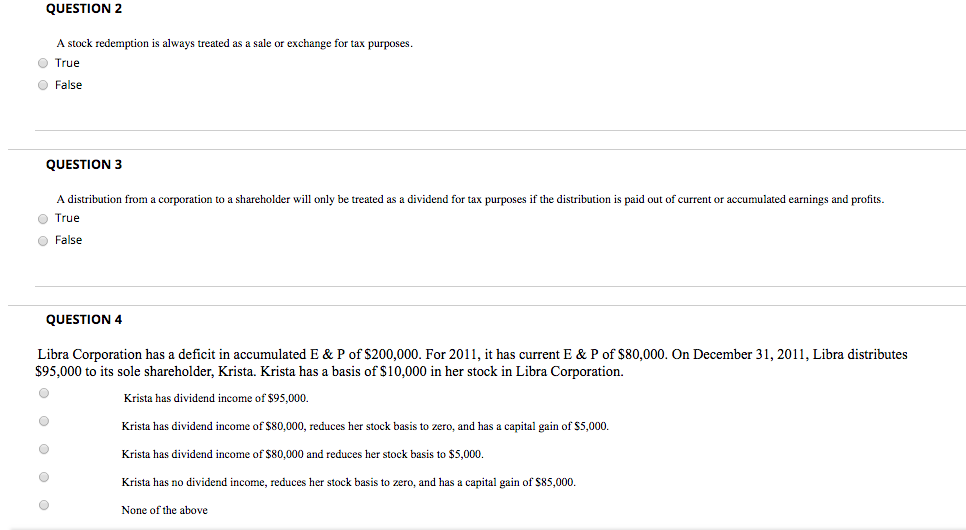

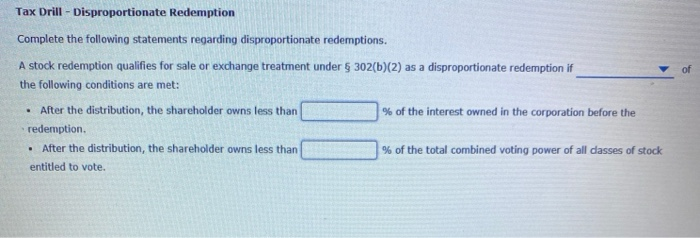

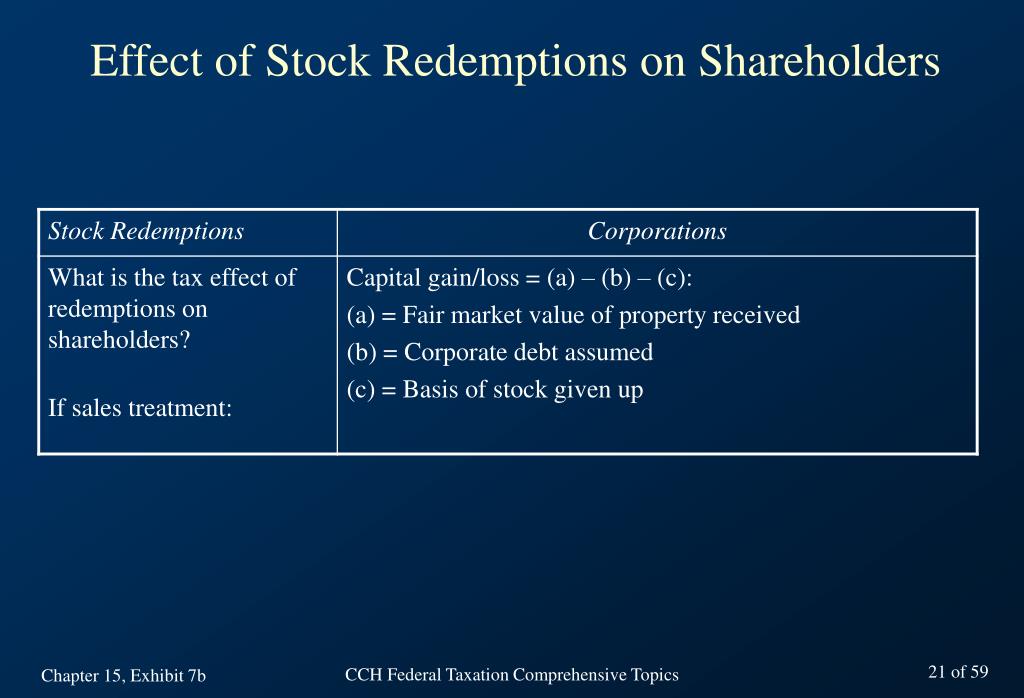

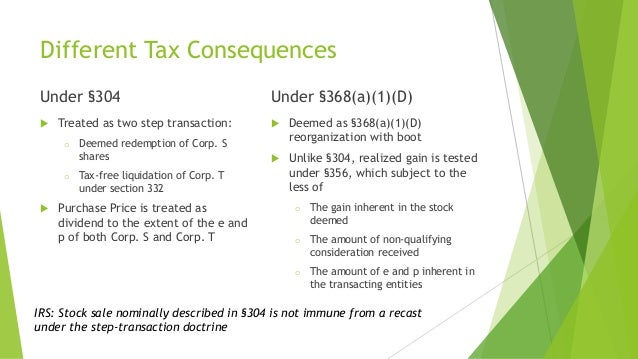

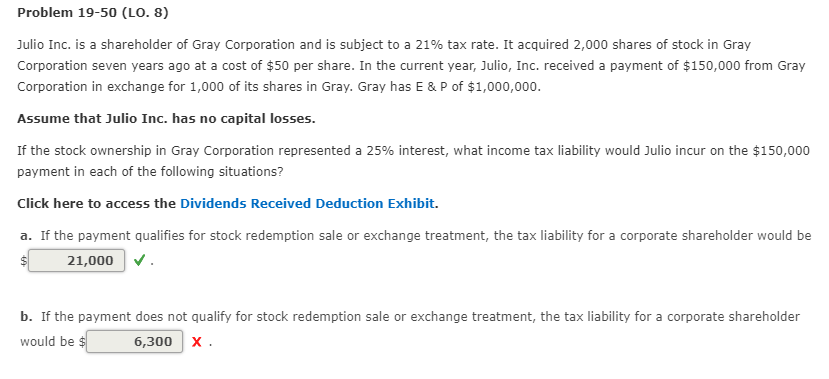

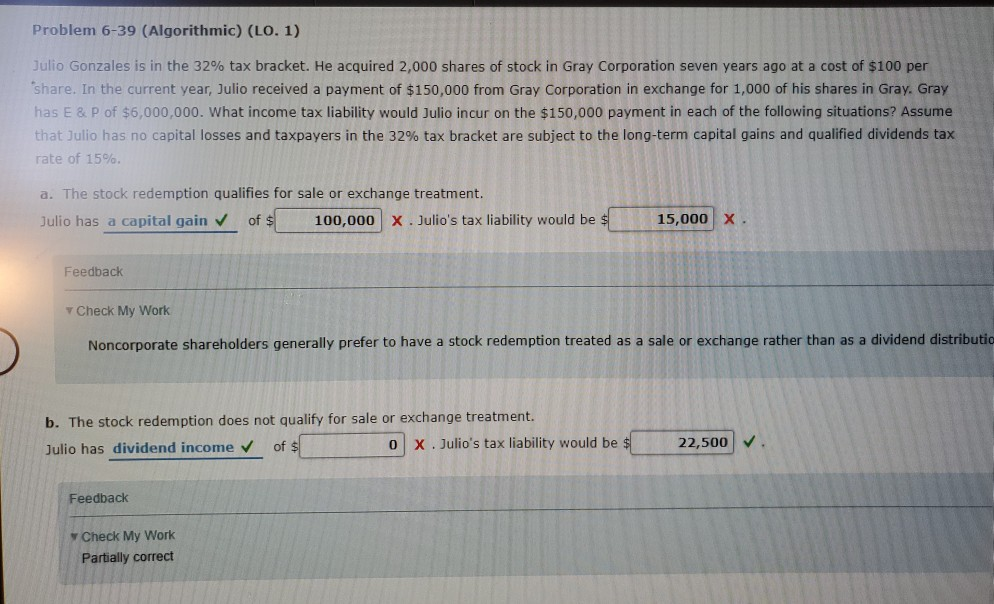

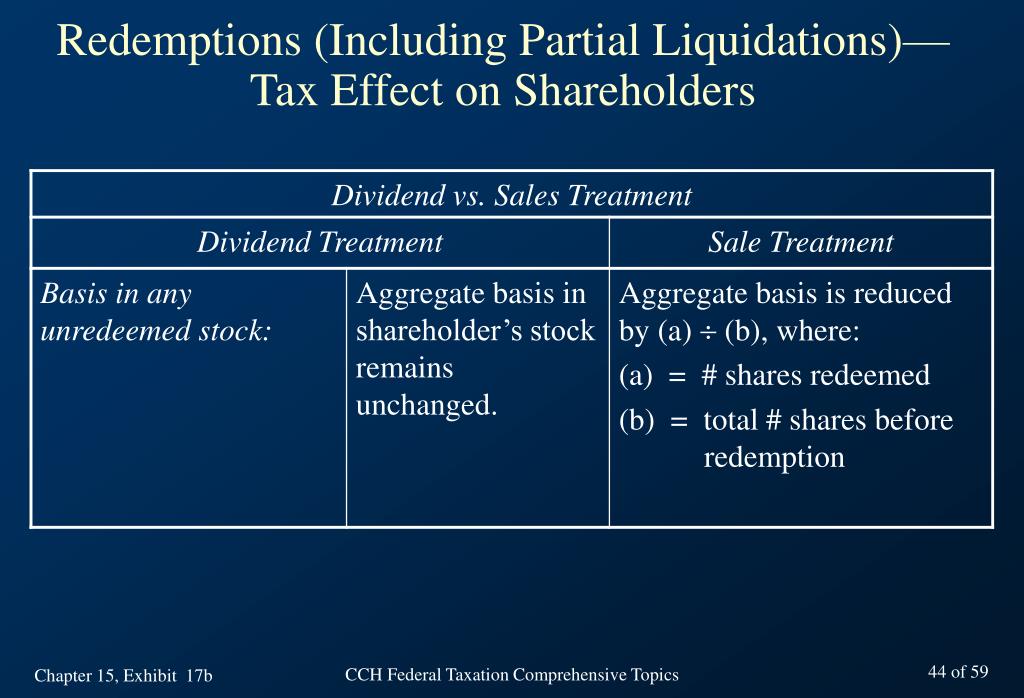

Stock redemption tax treatment. 2 Dividend equivalency no tax basis offset. Whether the redemption of the Preferred Stock could fit in any of the four categories in 302b when determining whether the redemption is to be treated as a sale or exchange. For a redemption to be treated as substantially disproportionate the shareholder must own less than 50 of the total combined voting power of all classes of stock entitled to vote immediately after the redemption.

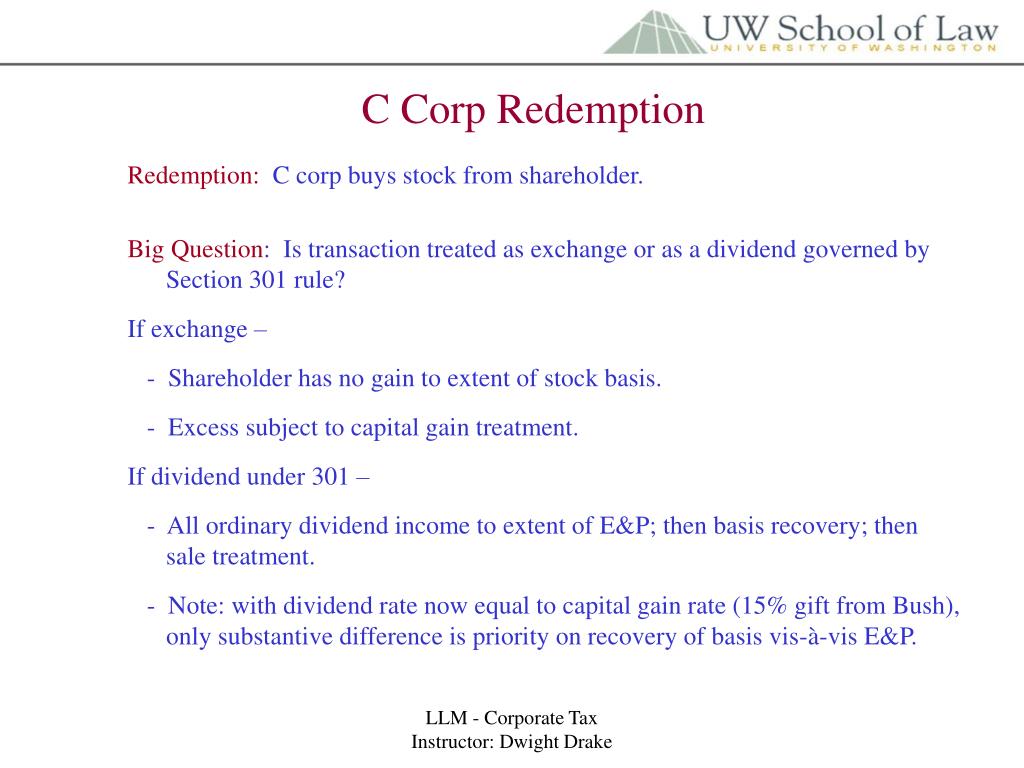

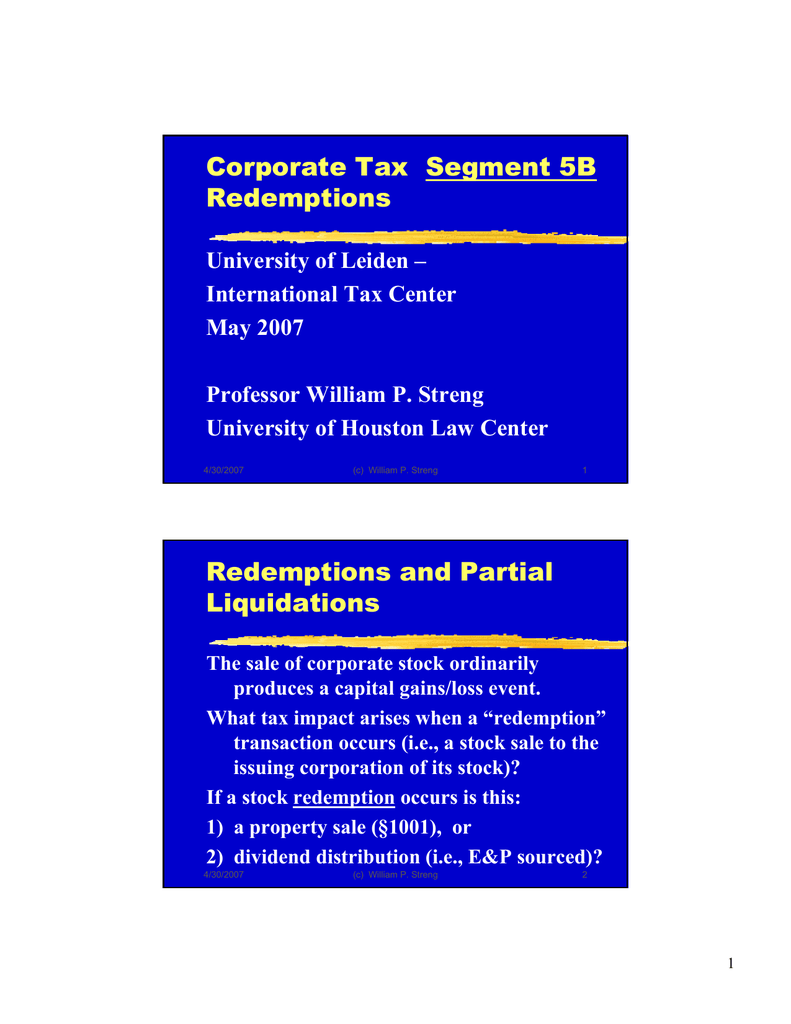

A redemption is treated as a sale if it is substantially disproportionate which requires. This is known as a stock redemption for tax purposes The redemption can be treated as an exchange or a sale with the resulting gain or loss treated as a capital gain or loss. 302 a distribution in redemption of stock is treated as a sale or exchange if the redemption.

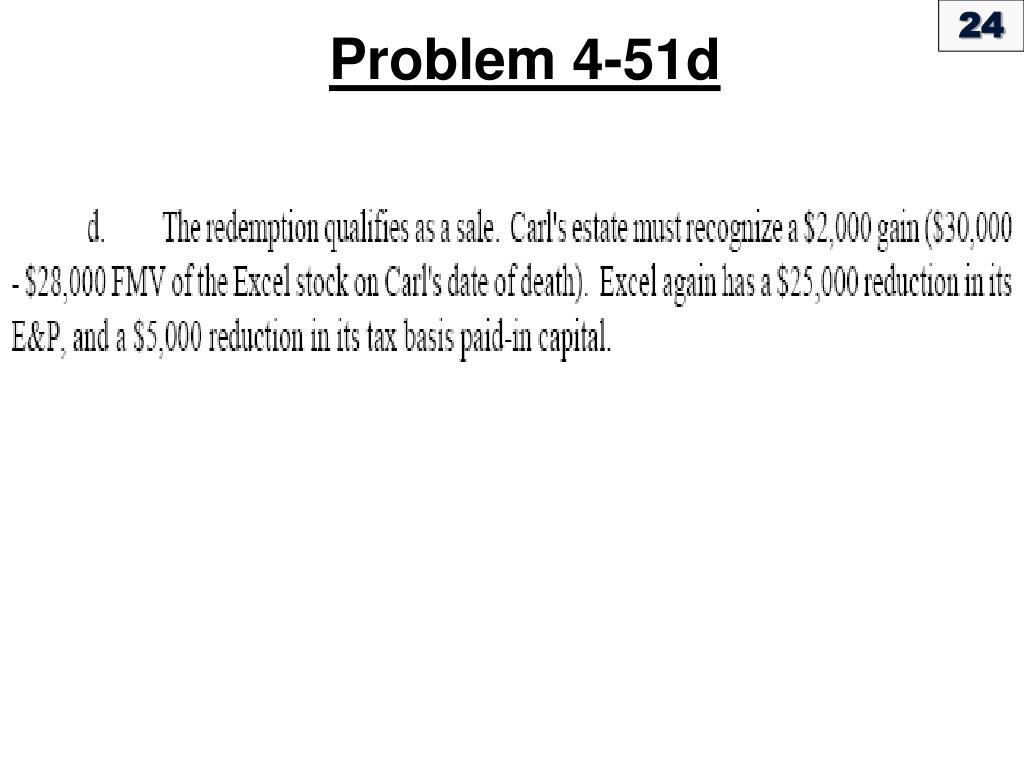

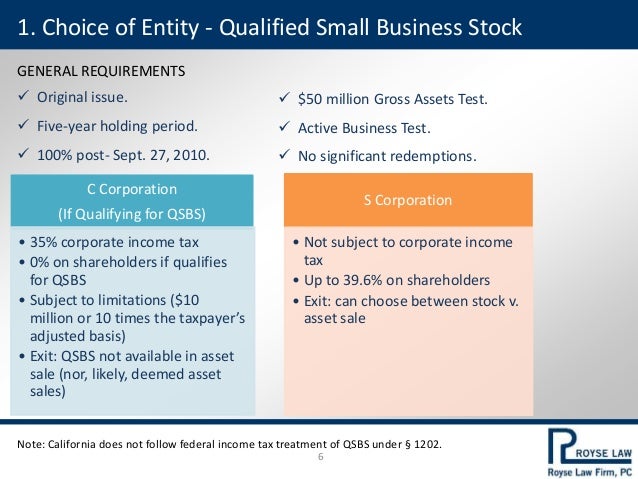

What is the relevance of the 2013 tax legislation 20 capital gains and 20 dividend tax rate. A redemption is a transfer by a shareholder of some or all of his stock to the issuing corporation in return for cash or other property. Generally under IRC Section 302 a redemption of stock will be treated as a distribution in part or full payment in exchange for the stock and therefore generate capital gain ie essentially.

1 Stock sale with an income tax basis recovery. Tax liability on stock redemption varies depending upon whether it amounts to sale or distribution. Because the redeemed shareholder held 100 of the stock both before and after the redemption the Court denied the sole shareholder beneficial tax treatment.

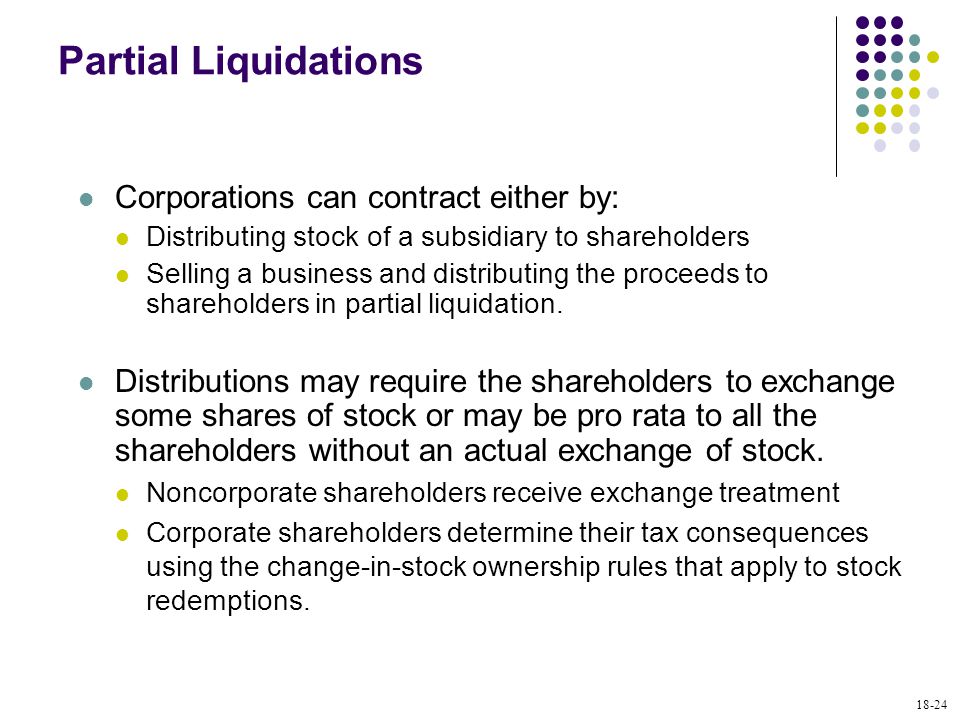

You are selling all of your S corporation shares or. And the shareholders percentage of both voting and nonvoting stock to be reduced by more than 20. Alternatively the redemption transaction can be treated as a distribution.

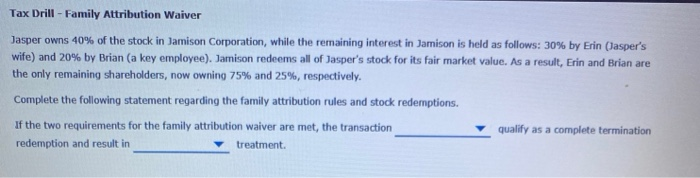

Consequently most redemptions by closely held corporations are treated as dividends but there is an important exception in cases of complete redemption of the shareholders interest. Is not essentially equivalent to a dividend. The Court also made clear that the business purpose of pro rata distributions is irrelevant in this determination.

For example if both classes of Preferred Stock were redeemed Corp1 could treat the redemption as a complete termination of interest under 302b3 and. The general rule for a stock redemption payment received by a C corporation shareholder is the payment is treated as a taxable dividend to the extent of the corporations earnings and profits similar to the financial accounting concept of retained earnings.

This is known as a stock redemption for tax purposes The redemption can be treated as an exchange or a sale with the resulting gain or loss treated as a capital gain or loss.

The tax treatment will depend on the facts and circumstances of each case. If the redemption is treated as a. Generally under IRC Section 302 a redemption of stock will be treated as a distribution in part or full payment in exchange for the stock and therefore generate capital gain ie essentially. You are selling all of your S corporation shares or. The Court also made clear that the business purpose of pro rata distributions is irrelevant in this determination. The tax treatment will depend on the facts and circumstances of each case. Sale Versus Distribution If a redemption is made by a C corporation the selling shareholder generally prefers the sale or exchange tax treatment noted above. Under IRC section 318 a a taxpayer is deemed to own the stock owned by family members. The shareholder may own a majority of the stock even 100 before the redemption.

1 Stock sale with an income tax basis recovery. Consequently most redemptions by closely held corporations are treated as dividends but there is an important exception in cases of complete redemption of the shareholders interest. If the redemption is treated as a. Sale Versus Distribution If a redemption is made by a C corporation the selling shareholder generally prefers the sale or exchange tax treatment noted above. Tax liability on stock redemption varies depending upon whether it amounts to sale or distribution. B Redemptions treated as exchanges. 2 Dividend equivalency no tax basis offset.

Post a Comment for "Stock Redemption Tax Treatment"